Va loan approval calculator

Required Income This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. Borrowers often acquire a short-term construction loan from their lender or builder then refinance that loan into a VA mortgage after the home is complete.

Va Loan For A Second Home How It Works Lendingtree

Free calculators for your every need.

. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Second mortgages come in two main forms home equity loans and home equity lines of credit. Mortgage loan basics Basic concepts and legal regulation.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Annual mortgage insurance premium. The VA offers specific guarantees to private lenders that handle VA loans.

Once youve determined that youre eligible the application process for a VA home loan should take around 40 days to complete. To use our mortgage calculator slide the adjusters to fit your financial situation. Bi-weekly Payments for an Auto Loan Calculator.

See if your condo is VA-eligible Sep 15th 2022 VA condo approval requirements. This is a one-time payment which is 23 of the total loan amount for first-time VA borrowers and 36 for people who have previously used the VA home loan program. A VA loan is a type of government loan backed by the US.

Loan approval is subject to credit approval and program guidelines. The first calculator figures monthly home payments for 30-year loan terms. Before your official loan timeline begins you should strongly consider obtaining a full pre-approval from your Mortgage Advisor.

Can you use a VA loan to buy a condo or townhome unit instead of a single-family home. Another veteran who has VA loan entitlement can be a co-borrower as long as this person will live in the home with you as his or her primary residence. Not all loan programs are available in all states for all.

Bi-weekly Payments for Looking to save money on a car loan. However some VA lenders impose their own waiting period of up to 12 months. Because of these guarantees lenders offer loans that typically feature no down payment to veterans and they may have less stringent requirements than other loans.

The VA requires you to wait 7 months 210 days from your last loan closing before using the VA Streamline Refinance. Buying a Manufactured Home With a VA Loan. Pre-approval Home Shopping.

Fannie Mae HomePath. Department of Veterans Affairs VA. Youll get a good handle on your ability to land a VA loan during the first step loan preapproval.

VA approval for new developments depends on the number of units sold. 045 percent to 105 percent depending on the loan term 15 years vs. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Current and former service members can also use their hard-earned military benefits to purchase a manufacturedmobile home. Before the Timeline Starts. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages.

Required Income Calculator for a Mortgage Calculator. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. VA borrowers who put 5 down.

You might consider making bi-weekly payments. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018. Veterans and service members dont need to know if theyre eligible for a VA loan to try and start the process.

Making a payment every other week rather than once a month can let you pay off your loan faster and save money on interest in the process. If youre looking for a jumbo mortgage that exceeds Fannie Mae and Freddie Macs conforming loan limit you can expect to pay a somewhat higher interest rate. Before applying for a VA loan for a new manufactured or modular home Veterans should understand that it can be challenging to find a lender willing to do a true 0 down construction loan.

For example that youre buying a single-family home as your primary residence. The calculator works. Once you have your pre-approval youll go home shopping.

Simply put the answer is yes. Second mortgage types Lump sum. VA Loan Employment Requirements for Workers On the Job Less Than 2 Years VA loan lenders typically require two years of consistent income but every employment scenario is different.

Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. The VA loan process typically takes 30 to 45 days once youre under contract on a home although every buyers situation is different. Cash Out Mortgage Refinancing Calculator.

The 2021 conforming loan limit for single-family homes in most markets is 548250 although it can be as high as 822375 in high-cost markets. 30 years the loan amount and the initial loan-to-value ratio or LTV. You can change the loan term or any of the other inputs and results will automatically calculate.

Theyll face the same credit and financial scrutiny as a spouse. The VA IRRRL also known as a VA streamline refinance. For more information on why a pre-approval is important you can review this post.

But it assumes a few things about you. Applying for a VA loan to purchase a home can be an intimidating process especially for first-time homebuyers. This VA loan calculator provides customized information based on the information you provide.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Homeowner Tax Deductions. VA approval is required for this type of setup unless the veteran happens to be your spouse.

A manufactured home is a house built entirely in factories that are towed to the home site. VA Streamline refinance loans are relatively easy and can be completed quickly due to the fact that homeowners are refinancing from one VA Loan product to another. Follow these steps to apply for a VA loan with ease and purchase the home you deserve.

The condominium community bylaws include language that prevents resale or foreclosure without HOA approval The bylaws include right of first refusal language that prevents the owner from freely selling the unit. To help you see current market conditions and find a local lender current Redmond mortgage refinance rates are published in a table below the calculator. When the condo is located within a VA-approved condo development you can use a VA loan just like you would to buy a single-family home.

VA Streamline Refinance IRRRL Qualified VA borrowers have access to one of the most straightforward and powerful refinance options around. If you have less than two years on the job lenders make take into account several indicators such as past employment education and training. Your Guide To 2015 US.

Common reasons why the VA might deny approval on a condo loan includes the following.

Va Mortgage Calculator Calculate Va Loan Payments

Can I Afford To Buy A Home Mortgage Affordability Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Va Loan Calculator Check Your Va Home Loan Eligibility

Loan Estimate Form Explained National Va Loans

Va Loan Funding Fee Closing Cost Calculator

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Va Loan Calculator

![]()

Va Loan Affordability Calculator How Much Home Can I Afford

Va Loan Funding Fee What You Ll Pay In 2022 Nerdwallet

Common Va Entitlement Codes Definitions And Eligibility Requirements

Common Va Entitlement Codes Definitions And Eligibility Requirements

Downloadable Free Mortgage Calculator Tool

Va Loan Affordability Calculator How Much Home Can I Afford

Va Loan Funding Fee Closing Cost Calculator

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

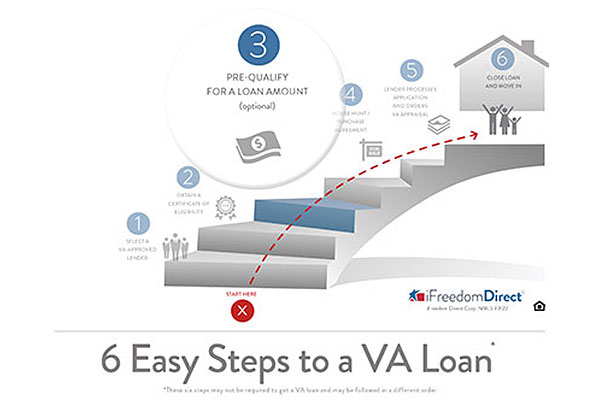

Step By Step To A Va Loan 3 Prequalifying Military Com